Creating long-term successful advice relationships is often focused on building strong personal relationships with clients. Investment and money can be sensitive subjects so earning trust is critical. Knowing your clients, understanding their goals, investment preferences and risk appetite is the foundation of any adviser/client relationship.

Yet the symbiotic relationship between technology and client relationships has become pivotal and investment platforms continue to enhance how financial advisers engage, understand, and cater to the diverse needs of their clients. Leveraging technology-driven strategies from the right platform partner can help foster enduring client relationships, strengthen referrals, and propel advice firms towards sustained success.

Digital Engagement: Creating opportunities for regular touchpoints.

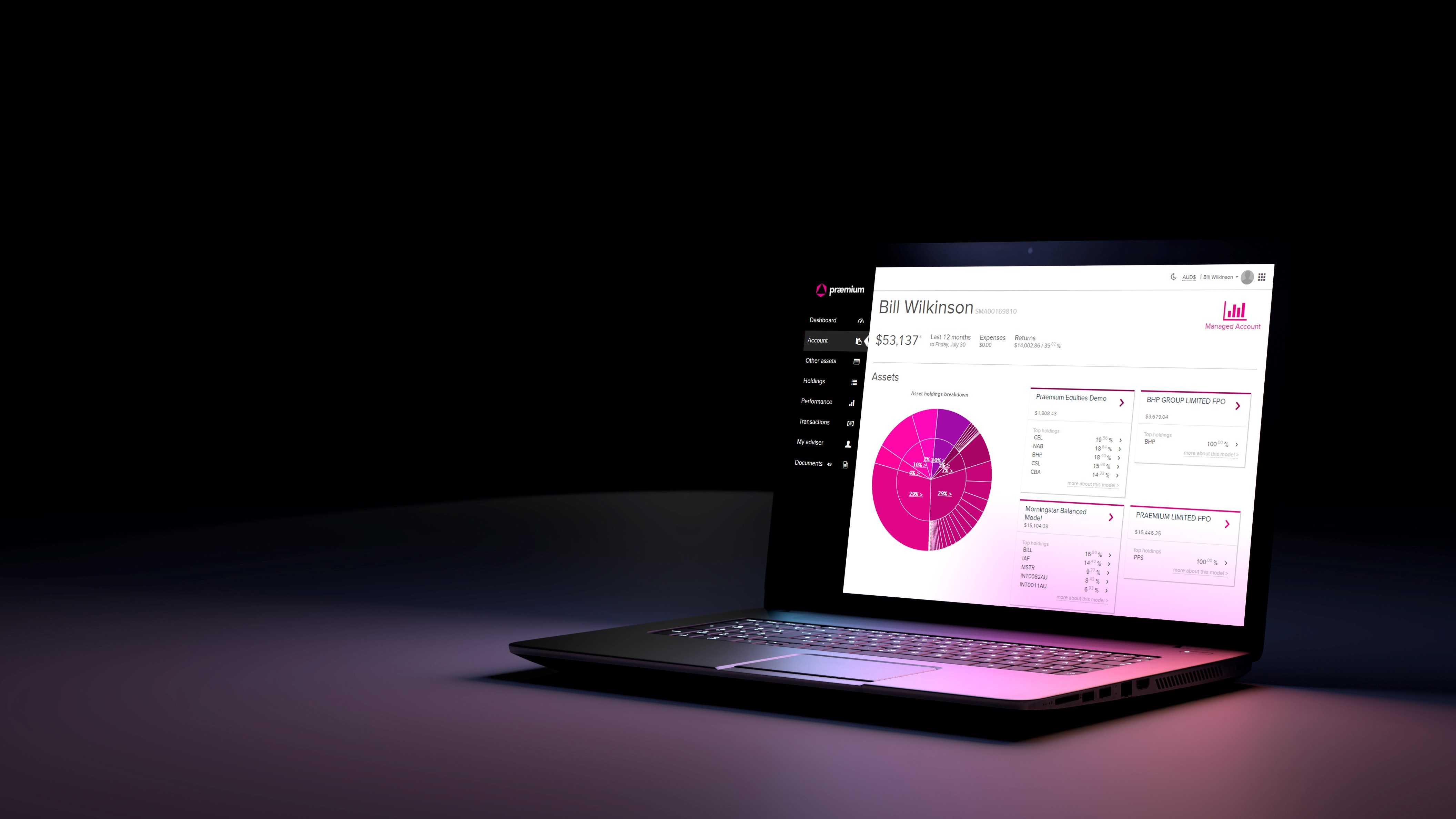

The paradigm shift towards digital engagement has redefined the accessibility of advice and how investors interact with their wealth management. Today 50% of investors believe their adviser should offer a digital solution [1], and 40% of customers prefer self-service over human contact [2]. Digital portals help to address these needs with the ability to self-serve, allowing seamless onboarding, digital approvals and immediate access to portfolio updates, reports, and documents, whilst also giving insights to advisers about how often their clients are engaging with this information.

While delivering a whole-of-wealth solution is still a challenge for many firms, this service is an increasing priority for many investors. Research by Accenture highlights that clients engaging through digital platforms report a 40% higher satisfaction rate with the advice process, owing to the convenience and immediacy of communication.

Personalisation in the Digital Realm

The digital evolution has driven an expectation for an increasingly personalised service. When it comes to wealth management, 55% of investors feel the advice they receive is too generic [1], and 34% would increase their investments if they received a hyper-personalised experience [1].

Investment platforms can help craft tailored investment strategies with personalised asset allocation and benchmarks aligned to specific client goals to deliver a truly personal investment portfolio. Custom reports can curate information to the specific needs or requests of the client as well as the business and service model of the advice firm. From deep-dive portfolio analysis to high-level infographics all delivered scalably and efficiently.

Deliver a personalised service with market-leading reporting

Enhance client satisfaction with digital engagement

Aligning values with wealth: the prioritisation of Responsible Investment

Whilst millennials have led the charge to responsible investing, interest in sustainable investing is increasing across all demographic groups. More investors want to have a positive impact with their wealth choices with 81% wanting to align their investments with their values [3]. It’s another way to deliver the personalised tailored approach investors seek and have a deep values-based conversation that can further enhance the advice relationship. Platform technology has made advances with screening filters and analysis tools to support conversations and creating easy-to-implement solutions that are uniquely aligned with an investors’ ethics and morals.

Discover our collection of insightful articles, engaging podcasts, interactive webinars, and dynamic videos, designed to guide you through the evolving world of ESG.

Building Digital Empathy: The Human Touch in Technology

Empathy remains the cornerstone of enduring client relationships, and it is even more important in today’s post-pandemic digital landscape, where face-to-face contact is markedly reduced. Investment platforms are beginning to embed artificial intelligence and machine learning capabilities to gauge client emotions and concerns and allow advisers to pre-empt client needs. This technology-driven insight yields impressive results, with a study conducted by Fidelity Investments showing a 35% increase in client advocacy among those who experienced empathetic digital interactions. Over the coming decade, this is an area that we expect will rapidly grow.

Creating a Unified Wealth View

Consolidating wealth data into a cohesive, comprehensive view is imperative for providing holistic advice, and 50% of high-net-worth investors would welcome the ability to access and manage their whole investment portfolio through a single digital experience.[4] Yet it remains a challenge for many platforms. Those that can, such as Praemium, aggregate data from various sources, with custody and non-custody assets and bring them together for both advisers and clients, offering a whole-of-wealth management experience.

Trust in the Digital Age: Cybersecurity and Data Privacy

The advent of digital advice services necessitates robust cybersecurity measures and stringent data privacy protocols. Transparent communication on data handling practices is pivotal in fostering trust and confidence with clients. Digital portals and multi-factor authentication are other ways platforms help, ensuring information and data are protected behind password-secured firewalls rather than transmitted using email.

The Path to Long-Term Success: Referrals through Relationships

A successful advisory relationship is not solely about revenue generation, but also the personal referrals it generates. Investment platforms when seamlessly integrated, with empathetic engagement and personalised services, can amplify client satisfaction. Leading advice consultancy Business Health noted that client satisfaction directly correlates to increased retention and organic referrals.

While face-to-face interactions will continue to be the key factor in building strong client relationships, the transformative power of investment platforms to enhance the client engagement model and support enduring client relationships is undeniable. Selecting the right platform partner to provide a consistent superior client experience will be paramount. By harnessing the capabilities of the right platform to decode client needs, deliver personalised services, fortify trust, and amplify empathy, advisers pave the way for lasting, referral-rich relationships that stand the test of time.

Webinar: Building longevity in advice relationships with technology

Leveraging technology-driven strategies from the right platform partner can help to foster enduring client relationships, strengthen referrals, and propel advice firms towards sustained success.

In this webinar, Praemium's Matt van Dijk, General Manager Distribution, looks at several key drivers for building client longevity and some examples of technology features you can use to maximise client engagement, deliver a personalised service and build trust with your clients.

View webinar

[1] Accenture Wealth Management Consumer Report

[2] Aspect

[3] Natixis Investment Managers 2020 Global Survey of Financial Professionals and 2019 Global Survey of Individual Investors

[4] Praemium/Investment Trends HNW Investor Research 2023